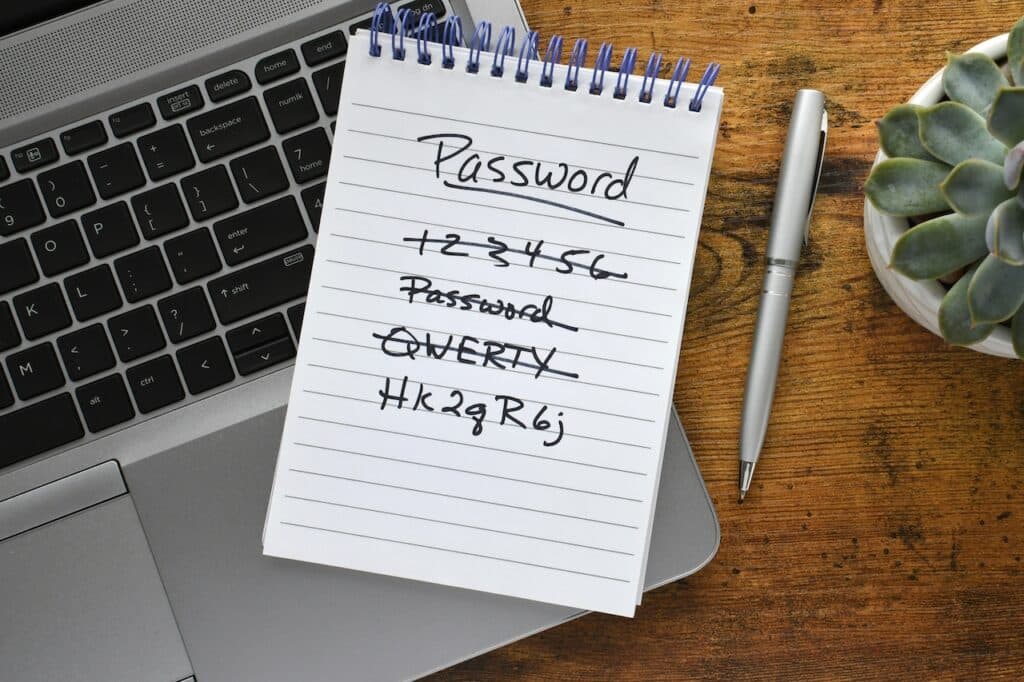

In March of 2022, TransUnion South Africa announced that their records had been breached—the group that took responsibility for the hack claimed that they stole 54 million records. They also claimed that the server they hacked was protected with the word “password.”

It’s the oldest security joke in the book but if what the hacking group claims is true, it’s no laughing matter! Making sure your employees know the best practices for creating secure passwords is a crucial first step in keeping valuable data safe from cybercriminals.

You don’t have to be an IT expert to understand password security basics, but it helps to make sure that all of your employees are on board with the same standards. Here are some key tips that you can relay to your staff.

The Risks of Poor Password Security

The first thing you want to make sure your employees understand is the risks associated with weak or reused passwords. If an employee reuses a password and it’s leaked in a data breach, hackers can use that same password to log into other accounts your company owns.

This means they could have access to customer information and financial records. With banking cybersecurity, employees need to know that it’s not just the business that’s at risk. With the sensitive information you store, each of your customers could have not just their money stolen, but their identities as well.

Data breaches from financial institutions have a ripple effect that a lot of other industries don’t have to worry about—but taking basic steps like password security can minimize the chances of a breach.

What Are the Current Password Guidelines?

The Federal Financial Institutions Examination Council (FFIEC) shares password best practices—they’re not regulations (yet) but they do provide a good framework for understanding what the industry considers to be secure passwords.

The FFIEC currently recommends that you:

- Implement an adequate password policy

- Change default passwords and settings for system-based credentials

- Review the business processes around password recovery

- Conduct regular audits to review the access and permission levels to critical systems for employees and contractors

- Implement least privileges access policies across the entire enterprise

- Encrypt sensitive data in transit and at rest

We’ll dive deeper into what your password policy should include and for the rest of the guidelines listed, it would be worth your time to consult with your in-house IT team or an IT provider.

4 Things You Can Do Today to Strengthen Your Banking Cybersecurity

No matter what industry your business is in it’s important to make sure you have the right security measures in place, but banking cybersecurity requires a heightened level of care. Here are four steps that can help strengthen your financial institution’s protections:

1. Conduct Regular Training Sessions for All Staff

Make sure everyone on your team knows and understands the importance of password security and other cybersecurity best practices. Research shows that people forget about 70% of what they’ve learned within 24 hours of hearing it.

People need constant reminders of the risks and benefits of password best practices. We understand that password policies are a bit of a yawn—nobody likes keeping track of all those different numbers and letters. To make it easier for your employees, you can use a password management system.

But above all, it’s important to make sure everyone understands the risks associated with weak passwords and why changes need to be made.

2. Use Multi-Factor Authentication for All Logins

Multi-factor authentication (MFA) is an extra layer of security that requires someone logging into an account to prove their identity in two or more ways, such as using a password and another form of verification like a one-time code sent via text message.

MFA can help protect against phishing scams, hackers, and other malicious activities because it makes it harder for someone to access an account without the proper credentials. Make sure all employees understand how MFA works and why it’s important.

3. Implement a Password Policy and Stick to It

A good password policy can go a long way in helping protect your financial institution from cyber threats. Make sure you create and implement strict guidelines around password security for both employees and customers, such as:

- Requiring all passwords to have at least 8 characters including upper case letters, lower case letters, numbers, and symbols

- Restricting the reuse of passwords

- Encouraging the use of two-factor authentication

- Enforcing a periodic password change policy

- Ensuring all accounts have distinct access levels with least privilege

4. Review All Third-Party Vendors and Their Security

Your financial institution likely works with a number of third-party vendors, from payroll providers to cloud storage companies. It’s important to review each vendor’s security measures to ensure they are up-to-date and secure.

You should also have an agreement in place that details what information is being shared between the vendor and your financial institution, as well as how it is stored, transmitted, and managed. This will help make sure there are no weak spots in your security infrastructure that could be exploited by criminals.

By following these four steps, you can help ensure that your business is protected from data breaches and other potential security threats. Making sure that all of your employees know the best practices for creating secure passwords is a crucial first step in keeping valuable data safe from cybercriminals.

Simplify Banking Cybersecurity With RESULTS Technology

From password best practices to multi-factor authentication, RESULTS Technology can help you implement the most secure banking practices for your financial institution. Our data security solutions provide the highest level of protection to keep your customer and business data safe from threats.

We also offer regular training sessions to ensure everyone on your team is up-to-date with the latest cybersecurity best practices. With RESULTS Technology, you can be confident that your banking data is safe and secure.

Schedule a free assessment to learn more about how we can help simplify your cybersecurity needs.